Hsmb Advisory Llc for Beginners

Table of ContentsHsmb Advisory Llc for DummiesThe Hsmb Advisory Llc StatementsFascination About Hsmb Advisory LlcGetting The Hsmb Advisory Llc To WorkThe Definitive Guide for Hsmb Advisory LlcHsmb Advisory Llc Things To Know Before You Buy

Ford says to avoid "cash money worth or irreversible" life insurance policy, which is more of a financial investment than an insurance policy. "Those are extremely complicated, featured high compensations, and 9 out of 10 people do not need them. They're oversold because insurance policy agents make the largest compensations on these," he claims.

Handicap insurance policy can be expensive, nonetheless. And for those that choose lasting care insurance, this plan may make special needs insurance policy unnecessary. Check out much more about long-term treatment insurance and whether it's appropriate for you in the next area. Long-lasting care insurance can assist pay for expenditures connected with long-lasting treatment as we age.

Everything about Hsmb Advisory Llc

If you have a chronic wellness issue, this type of insurance policy can finish up being vital (Life Insurance St Petersburg, FL). Don't allow it stress you or your financial institution account early in lifeit's usually best to take out a policy in your 50s or 60s with the anticipation that you will not be utilizing it till your 70s or later on.

If you're a small-business owner, take into consideration securing your income by purchasing business insurance. In the occasion of a disaster-related closure or duration of restoring, organization insurance coverage can cover your income loss. Take into consideration if a substantial weather occasion influenced your storefront or production facilityhow would that impact your revenue?

And also, making use of insurance could occasionally set you back even more than it saves in the long run. If you get a chip in your windscreen, you may think about covering the repair service cost with your emergency situation financial savings rather of your car insurance. Life Insurance.

5 Easy Facts About Hsmb Advisory Llc Shown

Share these tips to secure liked ones from being both underinsured and overinsuredand seek advice from a trusted professional when required. (https://qn2zqpz6rch.typeform.com/to/btrlcl6T)

Insurance policy that is purchased by a specific for single-person insurance coverage or coverage of a household. The private pays the costs, instead of employer-based medical insurance where the company commonly pays a share of the costs. Individuals might buy and acquisition insurance from any strategies readily available in the individual's geographical area.

Individuals and families may qualify for financial assistance to lower the price of insurance policy premiums and out-of-pocket expenses, but just when enrolling through Link for Health And Wellness Colorado. If you experience certain adjustments in your life,, you are eligible for a 60-day period of time where you can enlist in a private plan, also if it is outside of the annual open enrollment period of Nov.

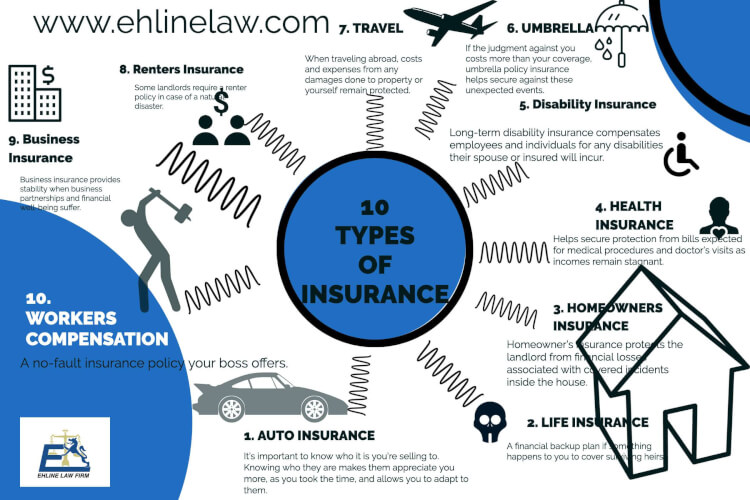

It might appear simple yet understanding insurance kinds can additionally be perplexing. Much of this confusion originates from the insurance industry's ongoing objective to make tailored coverage for insurance policy holders. In developing adaptable policies, there are a range to choose fromand every one of those insurance coverage kinds can make it tough to recognize what a certain plan is and does.

Examine This Report on Hsmb Advisory Llc

If you die throughout this period, the individual or individuals you've named as beneficiaries might get the cash payment of the plan.

Many term life insurance coverage plans allow you transform them to a whole life insurance coverage plan, so you do not lose insurance coverage. Typically, term life insurance policy plan premium settlements (what you pay monthly or year into your plan) are not locked in at the time of acquisition, so every 5 or ten years you own the plan, your costs might increase.

They likewise often tend to be more affordable total than entire life, unless you purchase a whole life insurance plan when you're young. There are additionally a couple of variants on term life insurance policy. One, called team term life insurance policy, is typical among insurance coverage options you may have accessibility to through your employer.

The Only Guide for Hsmb Advisory Llc

This is normally done at no expense to the staff member, with the ability see here to purchase additional coverage that's taken out of the worker's paycheck. Another variant that you may have access to via your employer is supplementary life insurance policy (Insurance Advise). Supplemental life insurance policy could consist of unexpected fatality and dismemberment (AD&D) insurance, or burial insuranceadditional insurance coverage that might aid your family in situation something unforeseen happens to you.

Permanent life insurance coverage just refers to any type of life insurance coverage plan that doesn't end.

Comments on “7 Simple Techniques For Hsmb Advisory Llc”